Content

Because a liability is always something owed, it is always considered payable to some entity. Liabilities in accounting are generally expressed as a “payable” alongside various qualifying terms. Listed in the table below are examples of current liabilities on the balance sheet. The values listed on the balance sheet are the outstanding amounts of each account at a specific point in time — i.e. a “snapshot” of a company’s financial health, reported on a quarterly or annual basis. Liabilities are the obligations of a company that are settled over time once economic benefits (i.e. cash payment) are transferred. A freelance social media marketer is required by her state to collect sales tax on each invoice she sends to her clients.

- Again, long-term liabilities are typically not due for settlement within the same year.

- So, when it comes to reporting a company’s finances, only certain contingent obligations need to be reported.

- Non-current liabilities are critical to understanding the overall liquidity and capital structure of a company.

- High accounts payable denotes greater credit facility being availed by the company.

- The liability is mostly settled by paying cash or sometimes by transferring any other economic benefit to the concerned party.

- Tim is a Certified QuickBooks Time Pro, QuickBooks ProAdvisor, and CPA with 25 years of experience.

Before joining FSB, Eric worked as a freelance content writer with various digital marketing agencies in Australia, the United States, and the Philippines. A contingency is an existing condition or situation that’s uncertain as to whether it’ll happen or not. An example is the possibility of paying damages as a result of an unfavorable court case. The condition is whether the entity will receive a favorable court judgment while the uncertainty pertains to the amount of damages to be paid if the entity receives an unfavorable court judgment. Tim is a Certified QuickBooks Time Pro, QuickBooks ProAdvisor, and CPA with 25 years of experience. He brings his expertise to Fit Small Business’s accounting content.

Current portion of long-term debt

In general, a liability is an obligation between one party and another not yet completed or paid for. Current liabilities are usually considered short-term and non-current liabilities are long-term . The liabilities of a business must be recorded and accounted for to keep track of all costs. In order for the business to keep track of what is owed to others, they should be recorded within the business’s accounts and financial statements. The balance sheet, for example, consists of both the liabilities of a company, as well as its assets.

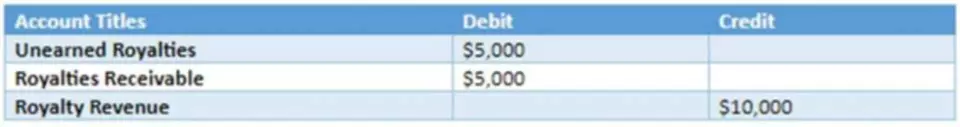

If the goods or services are not provided, the company has an obligation to return the funds. Compensation earned but not yet paid to employees as of the balance sheet date. Another popular calculation that potential investors or lenders might perform while figuring out the health of your business is the debt to capital ratio. Mortgage Payable – This is the liability of the owner to pay the loan for which it has been kept as security and to be payable in the next twelve months.

Short-Term Liabilities

This line item is in constant flux as bonds are issued, mature, or called back by the issuer. Liabilities are a vital aspect of a company because they are used to finance operations and pay for large expansions. They can also make transactions between businesses more efficient. For example, in most cases, if a wine supplier sells a case of wine to a restaurant, it does not demand payment when it delivers the goods. Rather, it invoices the restaurant for the purchase to streamline the drop-off and make paying easier for the restaurant. Companies in the energy sector, particularly oil, are an example.

What are the 5 current liabilities?

Current liabilities are the sum of Notes Payable, Accounts Payable, Short-Term Loans, Accrued Expenses, Unearned Revenue, Current Portion of Long-Term Debts, Other Short-Term Debts.

For example, if a company rarely uses short-term loans, it may group those with other current debts under an “other” category. Contingent liabilities are a special type of debt or obligation that may or may not happen in the future. The most common example of a contingent liability is liability accounts legal costs related to the outcome of a lawsuit. For example, if the company wins the case and doesn’t need to pay any money, it does not need to cover the debt. However, if the company loses the lawsuit and needs to pay the other party, the company does need to cover the obligation.

Explanation of Liabilities Examples

In finance and accounting, a liability is a debt that is owed by a person or entity. Financial liabilities can also represent legal obligations to pay money into the future, such as a lease agreement. Also sometimes called “non-current liabilities,” these are any obligations, payables, loans and any other liabilities that are due more than 12 months from now. Current LiabilitiesCurrent Liabilities are the payables which are likely to settled within twelve months of reporting. They’re usually salaries payable, expense payable, short term loans etc. Some of the liabilities in accounting examples are accounts payable, Expenses payable, salaries payable, and interest payable.

A liability is a debt or other obligation owed by one party to another party. Probable liabilities are treated as contingent liabilities, and a note is given for such liabilities below the balance sheet. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice.

Liability Across Industries

A lower debt to capital ratio usually means that a company is a safer investment, whereas a higher ratio means it’s a riskier bet. Generally speaking, the lower the debt ratio for your business, the less leveraged it is and the more capable it is of paying off its debts. The higher it is, the more leveraged it is, and the more liability risk it has. See how Annie’s total assets equal the sum of her liabilities and equity? If your books are up to date, your assets should also equal the sum of your liabilities and equity.