Content

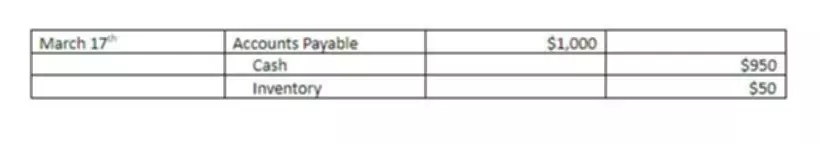

One of the items you will notice from companies like Facebook, Netflix, and Google, in their early years, they experienced losses from their bottom line. Below is a short video explanation to help you understand the importance of retained earnings from an accounting perspective. The SmartBiz® Small Business Blog and other related communications from SmartBiz Loans® are intended to provide general information on relevant topics for managing small businesses. Be aware that this is not a comprehensive analysis of the subject matter covered and is not intended to provide specific recommendations to you or your business with respect to the matters addressed. Please consult legal and financial processionals for further information. Businesses must continually examine their cost of goods sold (COGS) to ensure they are not overpaying for their inventory.

Non-cash items such as write-downs or impairments and stock-based compensation also affect the account. To begin, you will have to add your starting balance to your net income. Your starting balance is how many negative retained earnings retained earnings you had from the last accounting period. It is the amount of money a business makes

before

deducting expenses such as the cost of goods sold (COGS), operating expenses, and taxes.

How can you use retained earnings?

Retained earnings are often used to buy new equipment or finance research and development. The accountant will also consider any changes in the company’s net assets that are not included in profits or losses (i.e., adjustments for depreciation and other non-cash items). Once you consider all these elements, you can determine the retained earnings figure. A dividend issued from a deficit account is called a liquidating dividend or liquidating cash dividend.

- Where profits may indicate that a company has positive net income, retained earnings may show that a company has a net loss depending on the amount of dividends it paid out to shareholders.

- If you recall, retained earnings from last week’s post are the balance leftover from net income set aside for dividends, share repurchases, or reinvestment back into the company.

- This is because they may be well operating in share prices, and shareholders may be purchasing them very well.

- Find the amount that you started with in the equity section of your balance sheet.

- Many investors find it confusing that companies can pay a dividend, even when losing money.

Calculating retained earnings is not complicated once you understand how net income and dividends affect them. With this knowledge, managers can make informed decisions about how much money to distribute to shareholders versus keeping within the company. Retained earnings can either be positive or negative, depending on whether a company is making profits or losses respectively. Positive retained earnings indicate that the business is thriving and growing, while https://www.bookstime.com/blog/how-to-start-bookkeeping-business suggest that the company needs to improve its profitability.

Free Financial Statements Cheat Sheet

Simply search for annual reports and go to the balance sheet or CTRL + F to search for “retained earnings”. As mentioned, you need to know a few things to calculate retained earnings. Lenders and investors will consider retained earnings even more than net income when deciding whether to trust you with their money. See the following balance sheet of American Multinational cosmetics company, Revlon incorporation 2013. When considering decisions based on balance sheet investigations, we must remember the balance sheet is a snapshot in time and not necessarily what is transpiring with the company.